Massive Liquidations: In the past 24 hours, $840 million worth of leveraged positions were liquidated due to the market crash.

Underlying Causes: Potential reasons include a weak US economy, uncertainty regarding US Federal Reserve fiscal policy, and outflows from exchange-traded funds

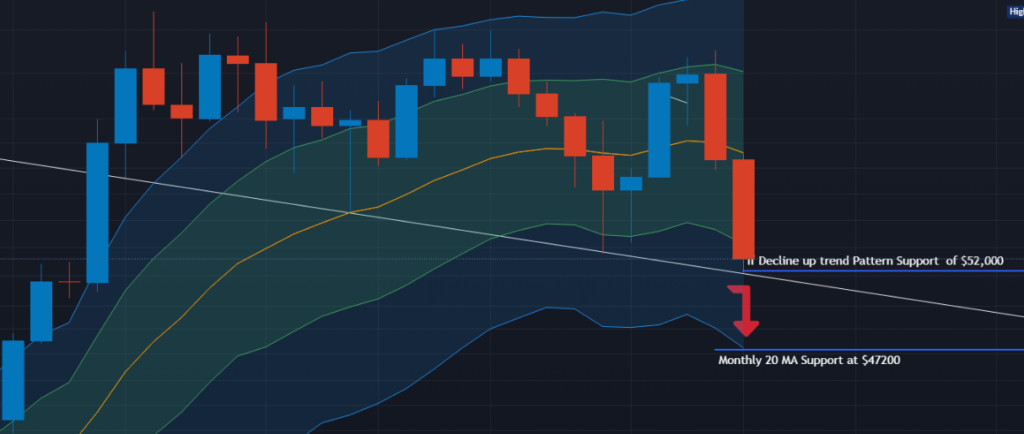

Finding BTC Support Analysis

When analyzing BTC’s uptrend, it’s important to note that $52,200 serves as a significant uptrend bounce-back level. According to the pitchfork uptrend pattern,

Bitcoin is currently at its second bottom, suggesting a potential pullback from this level. The second bottom is at $52,200, while the outer bottom line is at $45,000. Therefore, this support forecast is based on the pitchfork uptrend pattern.

Additionally, considering the moving averages, BTC’s Monthly 20 MA support is at $47,200. If BTC declines from the pitchfork pattern’s pullback support, it could potentially reach the Monthly 20 MA, which is at $47,200.

Highlights of Bitcoin’s Recent Price Crash

- Significant Price Drop: Bitcoin’s price crashed toward $53,000, losing over $17,000 since last Monday, marking one of its worst weekly performances ever.

- Speculation by Arthur Hayes: Arthur Hayes, former CEO of a leading derivatives trading platform, speculated that a major player might be dumping their crypto holdings, contributing to the crash.

- Jump Crypto Activity: The trading firm Jump Crypto moved hundreds of millions of dollars worth of various coins, including a $46 million transfer of ETH, suggesting possible liquidation of holdings.

Saturday, 5 July 2025

Saturday, 5 July 2025